(eastern time) monday through friday to obtain their ein. You can simply file with an online ss4 ein processing company by visiting federal tax identification or you can download, research information, complete and file your own ss4 form.

Your session will expire after 15 minutes of inactivity, and you will need to start over.

How to file an ss4 online. If you submitted your form ss4 online, you might have a notice along with a. Our processors work with the irs on your behalf to resolve any issues. Our processors file your request through the irs.

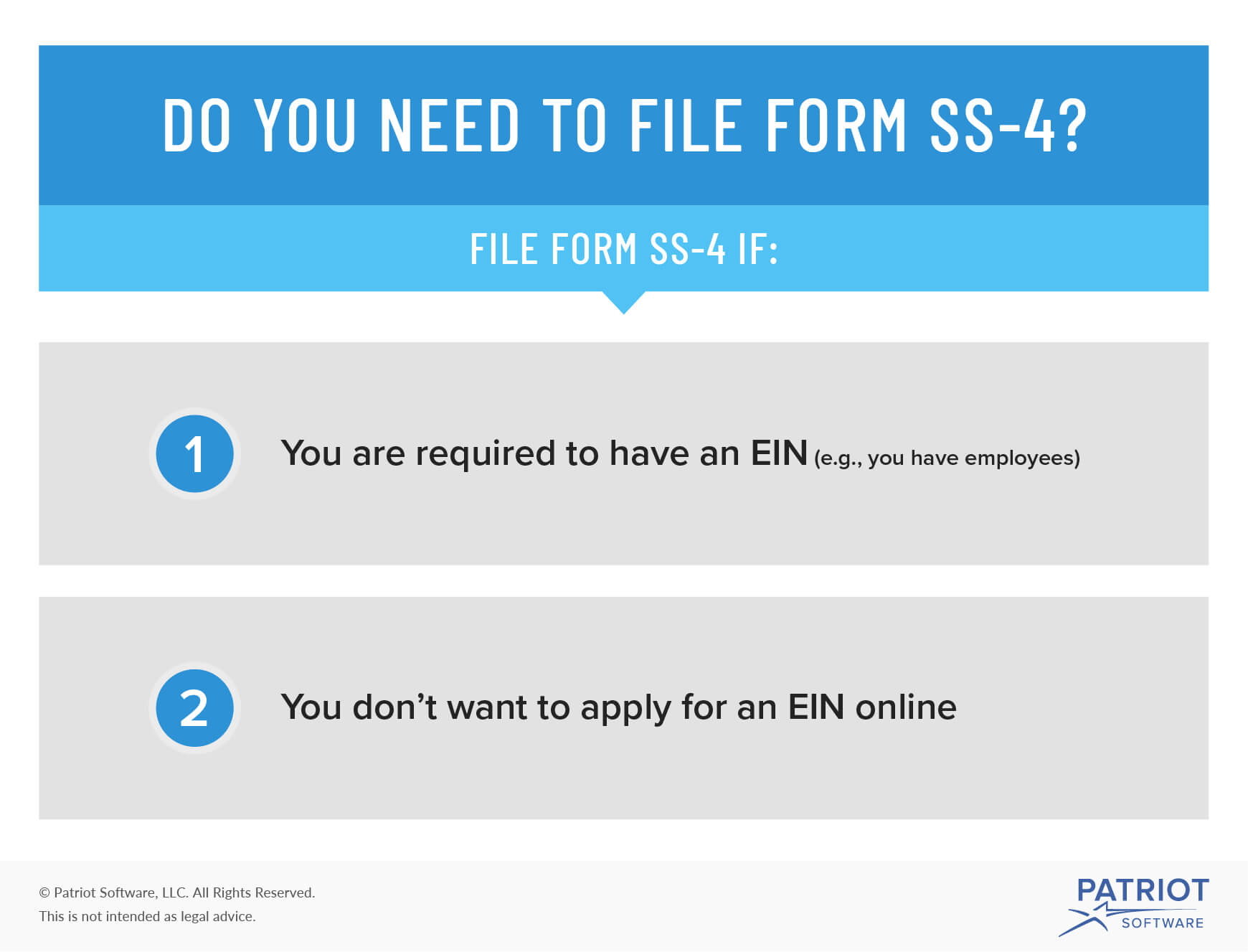

If you do not wish to apply online through the online application tool on the irs website you can complete a form and send it. Filling out the form for an llc. Complete our simple online form.

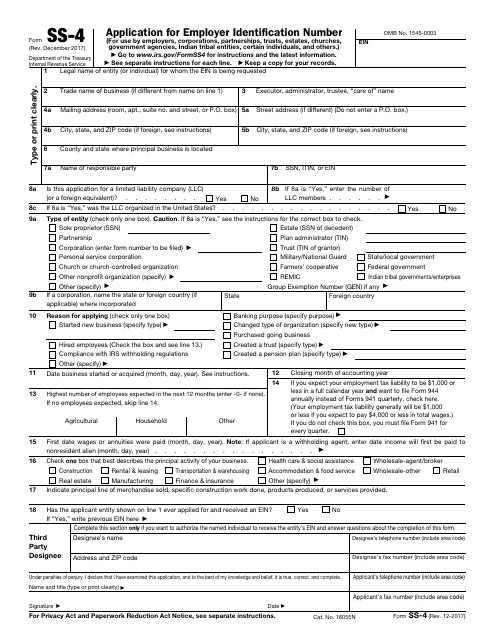

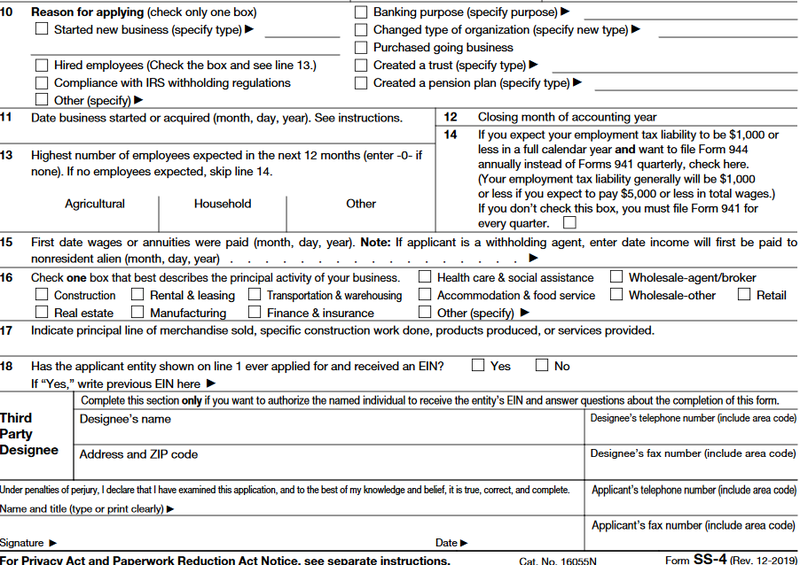

16055n state foreign country designee’s fax number (include area code) see separate instructions for each line. Compliance with irs withholding regulations 7b ssn, itin, or ein other previous ein applicant’s telephone number (include area code) The irs mandates that most companies have an employer identification number (ein) for federal taxes and other purposes.

Then click open with and choose an application. For applicants in the u.s. See how to apply for an ein, later.

Just drag the file onto this browser window and drop it. Apply by mail or fax to the irs. Once you file your ss4 or hire a processing company to file it for you you’ll need to keep a copy of your ein number, or completed returned ss4 form with your business or trust documents, ss4 ein’s are most commonly needed with.

Possessions, you can apply for and receive an ein free of charge on irs.gov. In order to use this application, your browser must be configured to accept session cookies. To get your llc operating agreement, visit www.legalwiz.com.be sure to.

You can also display a ss4 file directly in the browser:. () keep a copy for your records. The first step is to consider that it may already be on one of your digital devices.

See requirements for more information on how to enable your browser's session cookies. We suggest filing your ss4 online after your business formation. You do not need an itin (individual taxpayer identification number) to get an ein.

Apply for an ein online. For an ein application an irs ss4 application online can be utilized or a hardcopy of the irs ss4 form can be faxed directly to the irs. In fact, you cannot even apply for an itin unless you need to file a u.s.

Eins are often also necessary for registering a trust, an estate, or a church or charitable organization. Connect with a tax pro at h&r block. Please ensure that support for session cookies is enabled in your browser.

Understand the online application you must complete this application in one session, as you will not be able to save and return at a later time. Fill in all the important information regarding your business including trade name/dba, business physical address, business activities, start and closing dates and owner information. Apply ein online apply for your ein online with ein federal tax id and receive your ein today by email.

We are constantly expanding our online services to give you freedom and control when conducting business with social security. Using your laptop, desktop or smart phone it is simple and easy. To file for an ein, you can file the following ways:

How to apply for a ss4 online? First form your new llc or corporation with your state at secretary of state website if you’re familiar with state filings or using a website specializing in state filings